Beneficial Ownership Information (BOI) Report

Fellow business owners, this information is for you.

If you haven’t heard yet, there is a new federal reporting requirement that came into effect this year. Ignoring it could lead to serious penalties, so it’s important to stay informed and compliant.

Effective January 1, 2024 business entities registered with a State are required to file a Beneficial Ownership Information (BOI) report with the Financial Crimes Enforcement Network (FinCEN).

Note: On March 1st, 2024, an Alabama District Court declared The Corporate Transparency Act as unconstitutional. This court’s decision pauses the filings for members of the National Small Business Association only. As of right now, it still applies to everyone else. The Justice Department filed a Notice of Appeal on March 11, 2024.

Let’s go over the details of the Corporate Transparency Act and ensure we’re meeting our obligations to avoid any potential issues down the line.

What is the Corporate Transparency Act?

Enacted in 2021, the Corporate Transparency Act (CTA) protects the United States financial system from being used for illicit activities such as money laundering, shell companies, terrorist financing, and other illegal financial activities.

It achieves this by requiring specific non-exempt entities to reveal their Beneficial Ownership Information (BOI) to the Financial Crimes Enforcement Network (FinCEN).

Who Needs to File?

Companies required to file the BOI report are called “reporting companies”. These are domestic entities including LLCs, corporations, and any businesses registered with a State or the law of an American Indian tribe. This also includes foreign entities formed under the laws of a foreign country that are registered to do business in the United States.

Graphic from Fincen.gov

Who is Exempt?

There are 23 types of entities that are exempt from these reporting requirements. These include nonprofits, accounting firms, insurance companies, and certain large operating companies.

Click here for a full list of the 23 exemptions.

Who are Beneficial Owners?

Beneficial Owners are defined as individuals who own at least 25% of the company, which could include profit interests, options, or warrants.

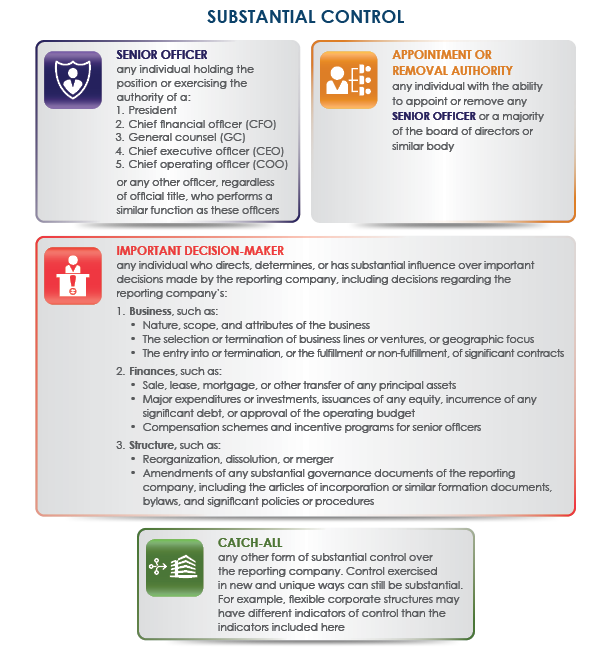

Additionally, individuals who exercise “substantial control” over the company, including the roles of President, CFO, CEO, COO, and General Counsel are considered Beneficial Owners.

Graphic from Fincen.gov

Who are the Company Applicants?

Company applicants are the individuals who directly file the document that creates the entity and (if different) the individual who is primarily responsible for directing the filing of that document.

This is not required for entities registered before January 1, 2024.

When are the Due Dates?

- Businesses created before January 1, 2024 must register by January 1, 2025.

- Businesses created in 2024 have 90 calendar days to register.

- Businesses created on/after January 1, 2025 have 30 calendar days to register.

What are the Penalties?

Violations include, failing to file a BOI report, filing false information, failing to correct or update a previously filed report. These can lead to serious and costly penalties:

- Civil penalties of up to $500 for each day the violation continues.

- Criminal penalties of up to 2 years imprisonment and a fine of up to $10,000.

How Do I File the Beneficial Ownership Information?

The filing process is simple and free of charge. You do not need an accountant or an attorney to do the filings and they are free to submit through the FinCEN website. You will file under the federal database called Beneficial Ownership Secure System (BOSS).

You only need to file BOI report once, unless you need to update or correct information.

Beware of scammers attempting to charge payment or solicit information on behalf of the CTA.

The information you will need for each beneficial owner includes:

- Full Name

- Date of birth

- Residential address

- Copy of U.S. driver’s license or passport

- The nature and extent of ownership

Keep in mind that accuracy and thoroughness are crucial. Failure to comply or incomplete filing may result in penalties of $500 per day and up to two years’ imprisonment.

Again, BOI filings are free at:

If you have any questions or wish for a professional to submit the filing for you, I recommend you reach out to an accountant or an attorney. You can contact me with any questions here.

The Comments

How to Choose the Right Business Entity - Amanda Waltz Law, LLC

[…] You can read more about The Corporate Transparency Act here. […]